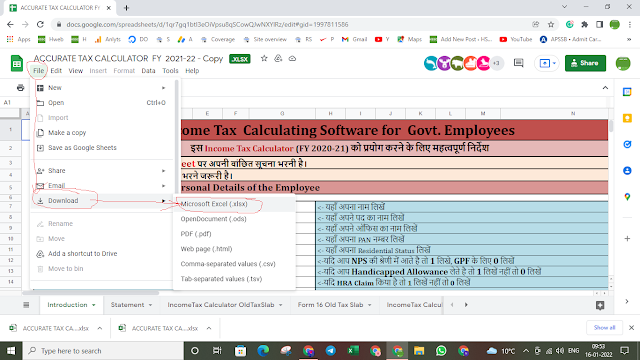

How to download IT calculator

Click on file left corner upper(See photo below)

Click on download

Click on excel.

Income Tax 2021-22 Saving & Deduction

Standard Deduction: 50000

Children Education Allowance: 2400

10(14). Hostel Expenditure Rs. 300 per month (Two-Child Rs. 7200 per annum)

HRA: 30000 (Without Any PAN Receipt), Actual HRA with PAN Receipt

Home Loan Interest: 200000

80C : 150000 (NPS/GPF/LIC/Home Loan Principal/Tuition Fee/PPF/SSY

NPS (New Pension Scheme) u/s 80CCD (1B) : 50000

NPS (New Pension Scheme) u/s 80CCD (2) : Total NPS Amount

80 D : Health Insurance u/s 80 D (Self 25,000, Self + Parents 25000 (<60-50000)

80D: Medical expenses Preventive health check-up 5000/- Maximum 50000/- (valid

payment mode like net banking, digital channels)

Bank Interest on Saving Account u/s 80 TTA (Maximum 10,000)

Interest on taken for Higher Education u/s 80E

Person with Disability u/s 80U) (40% - 75,000/ 80% -1,25,000)

No comments:

Post a Comment

thanks for your valuable comment